Update: QQQ Outlook for May 2022

This year remained tough for long term investors, specially if you are a growth & tech investor.

This year remained tough for long term investors, specially if you are a growth & tech investor. Not just that, SPY and Nasdaq are down 10% and 18% year to date too. Our Portfolio 2022 is down 9% as of today.

Like a broken record i keep insisting on having a longer term perspective, think like a VC, who invest and keep tab on company fundamentals and growth quarter after quarter. Believe in the companies you hold and always remember why you bought them initially. Also build position gradually over many quarters, instead of dumping all of your money at once. This is a bear market and you will get more opportunities to buy best companies at attractive levels.

Netflix is down nearly 70% year to date

This is a great example to read about and being a long term investor and continue to hold best and growing companies. This is not the first time NFLX had such a major draw-down. It has happened in 2004, when it dropped almost 75% and then between 2011-2012 when it dropped 80%. But it came back.

If management and leaders are visionary, led by founders, growing at scale and well run, such companies tend to come back.

My point here is, do not let market scare you out of your positions in good companies.

Check out our last update:

QQQ Outlook for next month:

Blue boxes shows bear markets. Current bear market has stark similarity with what we had in 2018-2019.

Back then QQQ managed to come back to 50DMA after 15% drop and then had immediate large leg down of around 10%. As you can see in the first blue box in below chart, QQQ was in total down 23% from top.

Current bear market (gray boxes), we are already down more than 20% and last month QQQ attempted a breakout of 50DMA, but couldn't break 100DMA and it fizzled. Now are heading towards 25% down and we might see it next few weeks.

I indicated in our last alert that we should be ready for another leg down, which is what we are witnessing this month.

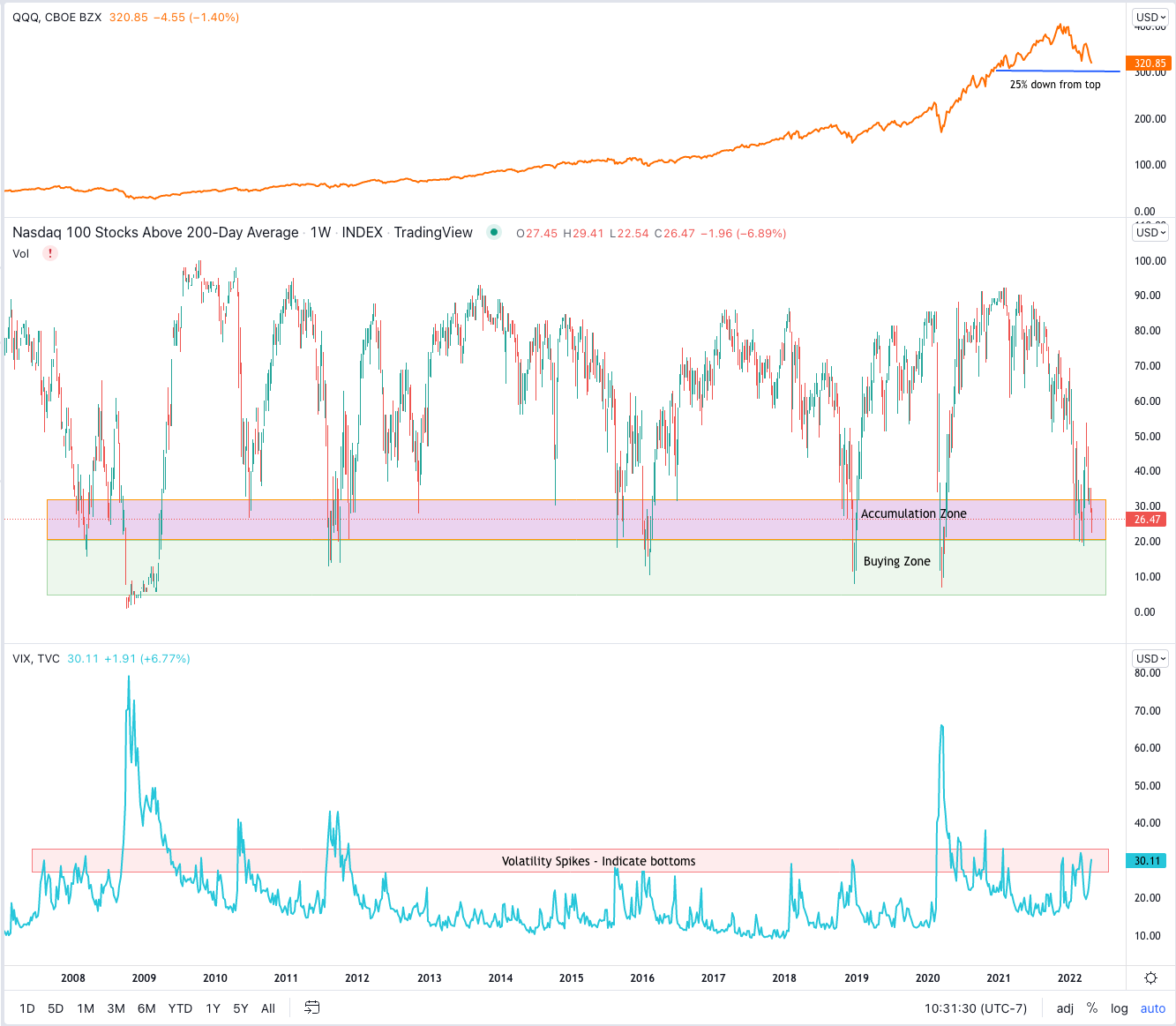

But we are at the bottom, at least in many tech stocks. Following chart shows % of stocks that are above 200 DMA. It helps us figure out to accumulate and buy zones.

In above chart:

Panel 1 shows QQQ index

Panel 2 shows NDX % of stocks above 200 DMA

Panel 3 shows VIX, volatility in the market

As you can see in this weekly chart, it's accumulation zone when % of stocks above 200DMA are down to below 30. That happend only handful of times in last 15 years. If it goes below 20, it's a Buying Zone.

Please be cautious for another few weeks and keep some cash. We did some great additions in last two months in our growth stock portfolio.

If you were standing at sidelines, this is the time to start a new position, if we go down from here you can use the cash at hand to buy more with the anticipation that market is near bottom and you will hold the stock for at least for next 5 years.

Don't look for instant gratification (instant profits, right after you buy), but try to understand the long term satisfaction of building wealth gradually.

-Alpha Investor