Alert: Buy these two 3D printing stocks

We are adding 3D printing stocks to our portfolio. Pandemic has accelerated growth in 3D manufacturing and it can turns out to be a pivotal catalyst for these companies.

We are adding 3D printing stocks to our portfolio. Pandemic has accelerated growth in 3D manufacturing and it can turns out to be a pivotal catalyst for these companies.

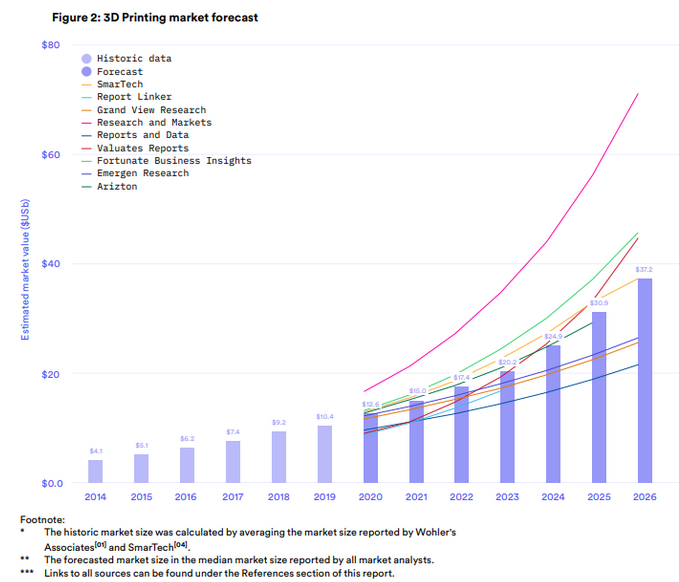

Global 3D printing market grew by 21 percent in 2020 compared to 2019 to an estimated value of $12.6 billion despite the effects of the Covid-19 pandemic. The adoption of additive manufacturing has been accelerated after Covid-19, with 65 percent of engineering businesses increasing their usage of 3D printing compared to 2019.

3D printing market will more than double in size over the next five years, reaching an estimated value of $37.2 billion in 2026.

To play this trend, we already own $XONE which recently got acquired by Desktop Metals (DM).

Today we are adding following two stocks in our Portfolio 2021.

- 3D Systems Corporation ($DDD) : Buy $DDD at $28.40 or better

- Desktop Metal Inc ($DM) : Buy $DM at $8 or better

Add each as less then 1% for your portfolio.

Start buying in smaller quantities for next several quarters and start learning more about these companies. Please do not focus on daily stock price movement, that is just a distraction. Learning the fundamentals and about the business is important.

3D Systems Corporation ($DDD)

3D Systems Corp. is a holding company, which engages in the provision of comprehensive three-dimensional printing solutions. It offers a comprehensive range of 3D printers, materials, software, haptic design tools, 3D scanners, and virtual surgical simulators.

It also develops, blends, and markets various print materials, such as plastic, nylon, metal, composite, elastomeric, wax, polymeric dental, and Class IV bio-compatible materials. In addition, the company provides digital design tools, including software, scanners, and haptic devices, as well as solutions for product design, mold and die design, 3D scan-to-print, reverse engineering, production machining, metrology, and inspection under the Geomagic brand.

Further, it offers 3D Sprint and 3DXpert, a proprietary software to prepare and optimize CAD data and manage the additive manufacturing processes, which provides automated support building and placement, build platform management, and print queue management; and 3D virtual reality simulators and simulator modules for medical applications under the Simbionix brand, and digitizing scanners for medical and mechanical applications.

It primarily serves companies and small and midsize businesses in medical, dental, automotive, aerospace, durable good, government, defense, technology, jewelry, electronic, education, consumer good, energy, and other industries through direct sales force, as well as partner channels and distributors.

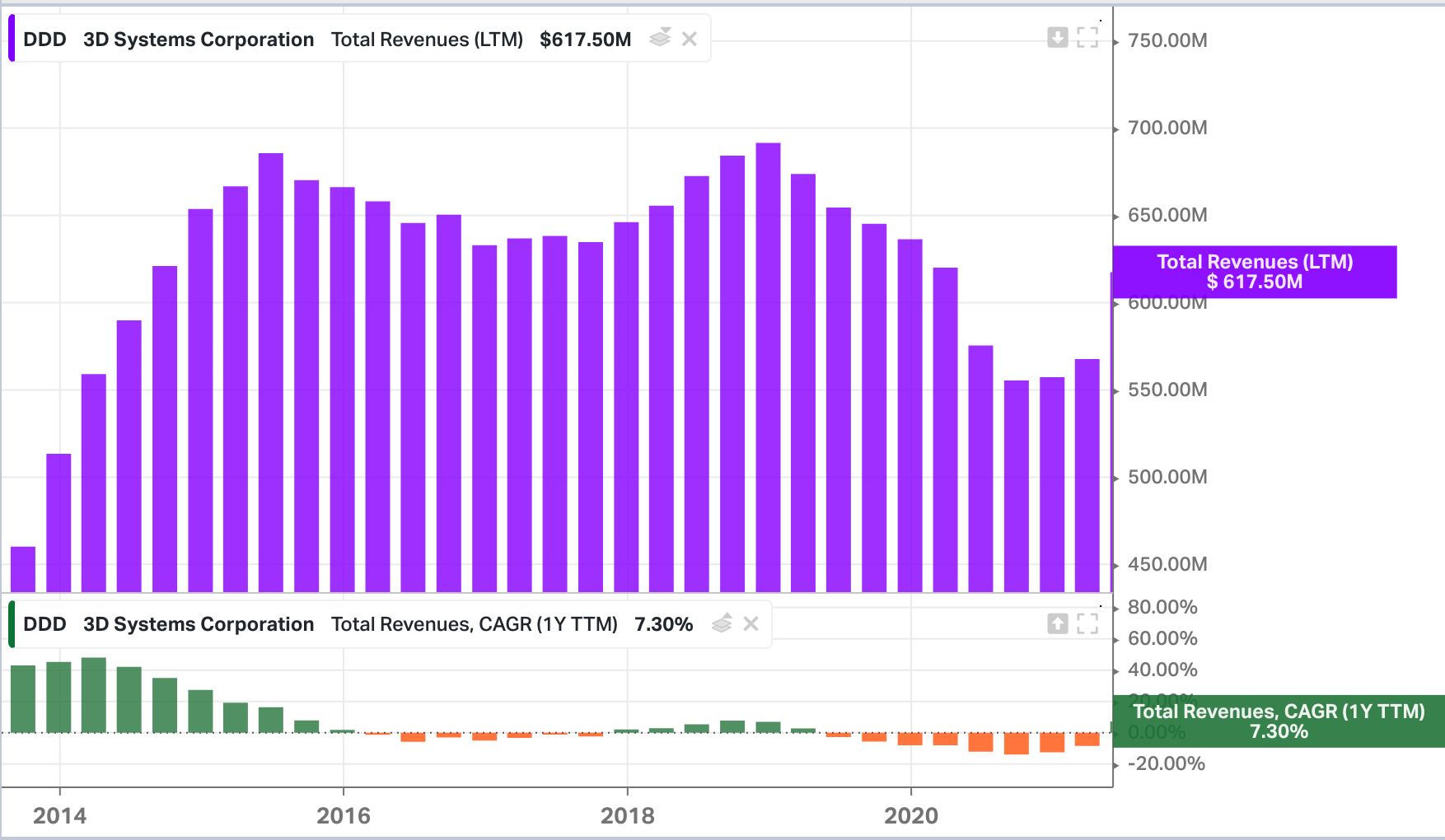

Revenues have been growing quite steadily, even though growth rates are still below 10%. This may accelerate once economic conditions normalize given the industry’s expected CAGR of 17% over the next 3 years.

As at 2Q2021, the company had cash of $131.8 million, no debt and a $100 million unused revolving credit facility. Cash increased $47.8 million since end-2020.

Desktop Metal Inc ($DM)

Desktop Metal, Inc. manufactures and sells additive manufacturing solutions for engineers, designers, and manufacturers.

The company offers Production System, an industrial manufacturing solution; Shop System, a turnkey binder jetting platform for machine and job shops; Studio System, an office metal 3D printing system; and Fiber, a desktop 3D printer. It serves automotive, aerospace, healthcare, consumer products, heavy industry, machine design, and research and development industries.

DM's could see strong growth in it's additive manufacturing as it's addressable market, that can expand to at least $54 billion by 2029. DM is expected to grow revenues to $100 million in 2021, up from $16.5 million in 2020, and continue with high double-digit growth for multiple years.

Within this year DM's has done many acquistion after came out of SPAC deal.

EnvistionTec, PhonoGraft, Adaptiv3D and Aerosint.

Acquisition of this nature aid growth not simply by expanding the material, technologies and systems portfolio, but by creating numerous different end market opportunities

Please don't rush to build positions. As we plan to hold them at least 5 years, you will get multiple chances. Start today by adding less then 1% of your portfolio.

-Alpha Staff